While dealing with the stock market nowadays, investors and traders must have seen different ups and downs in the market. The experienced one understand these short term or long term movements but the new admissions to this market will find these trends a big time headache!

Knowledge of stock market is incomplete without understanding and analyzing the market trend. The market trend gives a wide knowledge of the historical price patterns and movements of the stock and today in this blog post I will be discussing brief about the trend analysis, why should we study market trends and so on and so forth.

MARKET TREND ANALYSIS -A BRIEF INTRO

A trend is a broad upward (uptrend) or downward (downtrend) movement of stock’s price over the time like a wave. In one line, it is the direction in which the stock prices move. The upward movement of the price is the case when the price of the stock rises and this happens when the percentage of buyers is more than the sellers; similarly, downward movement happens when the stock prices fall and the percentage of sellers is more than the percentage of buyers.

And this process of understanding and analyzing the stock prices trends is known as market trend analysis. Market trend analysis is done to evaluate the current movements of the market and predict the future prices of stocks. We cannot be 100% assured with the future prediction of the market trend but yes this analysis can surely prevent in minimizing loses to a great extent.

WHY WE NEED TREND ANALYSIS?

Best things happen with time. Understanding market trends is the most important factor in order to invest in stock market. This is because, determining market trends tell us which stocks are expected to move up or down and how much is the risk involved.

The lack of considerate knowledge of market trends can be as dangerous as driving a car in the wrong direction. In fact, most of the investors lose out enough money because they do not study the market trend early.

After knowing the reason to study different trends in stock markets, let us know more about the types of the trends in the stock market:-

TYPES OF MARKET TRENDS

UPTREND

Uptrend is the case where the price of a particular stock is making successive increase i.e. Making higher highs and higher lows. In this scenario, stock prices touch a new high and falls lower in comparison to the previous value.

More and more investors buy whenever the price falls, which is the optimal solution for most of the investors.

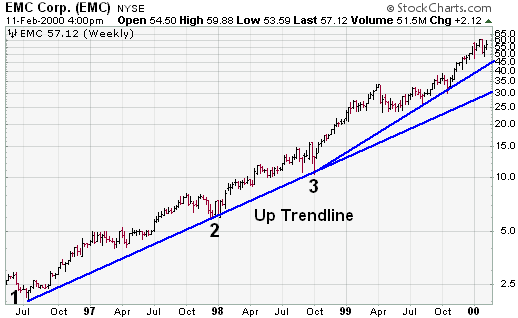

source:- http://stockcharts.com

Note in the above chart, the blue colored line is the uptrend line which is formed by connecting 3 points such that the three points form a positive slope.

DOWNTREND

Downtrend is the case where the price of a particular stock is falling constantly i.e. The stock is making is lower highs and lower lows.

In case of downtrend, investors prefer to sell on the bounces as there is a possibility that the prices will fall further.

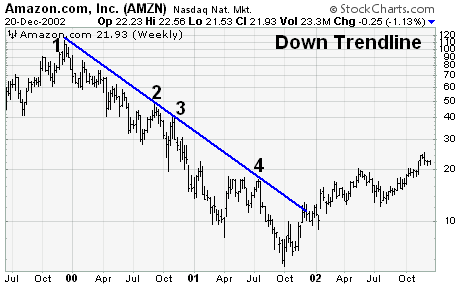

source:- http://stockcharts.com

Here the downtrend line is formed by connecting 3 points and these points are connected in such a way that they form a negative slope.

SIDEWAYS TREND

In a sideways trend the price of a particular stock does not move in either of the direction. There are no highs and no lows and hence no significant movement is made.

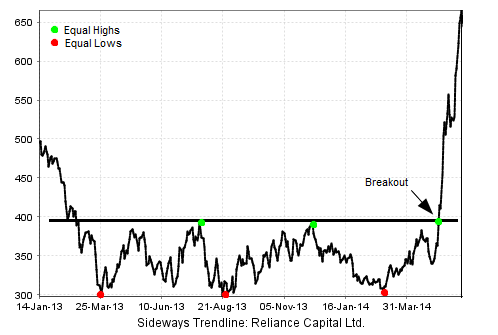

source:- http://topstocksearch.com

The stock market is a study that requires wide knowledge base and the study of different trends in the market. Analyzing and determining the trends of the market helps to cater extensive losses and control minimal profits.

Leave a Comments